There are many reasons why you may need to retrieve old bank statements from an account you previously closed. For example, you may need statements from a closed account for tax purposes if you are being audited and need to provide documentation for deductions or income from years past. Sometimes banks or other financial institutions require old bank statements for income verification purposes. Old statements are also useful for your own personal financial records, doing bank statement analysis, and tracking things like monthly expenses, savings, and other account activity over time. While closed accounts are no longer active, the bank will typically still have a record of those statements archived. Getting copies of these archived bank statements is possible, though it does require some persistence and knowing the proper steps to go through. With the right approach, you can successfully retrieve your old account records even from accounts closed long ago. This article will outline everything you need to know to get those needed statements from a closed bank account. The Future of Accounting with AI: Get Your eBook Today

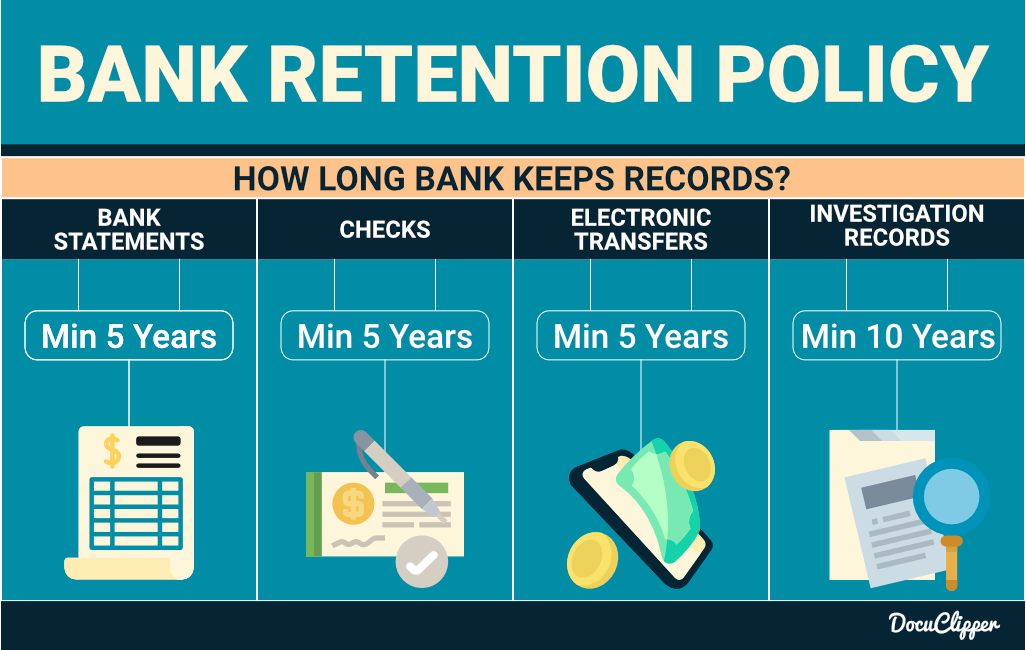

Banks are required by law to keep records of your bank statements, bank transactions, and account activity for a certain period of time, even after you close an account. Here are the key requirements for banks regarding retaining old account records:

So, in summary, you can expect that banks will have records of at least the past 5 years of statements, and likely longer in many cases.

The older the account, however, the less likely the bank still has accessible records in their main systems. Very old records may be archived offline.

Additionally, this can vary based on the country of the bank and the local government requirements for banks.

Therefore, it’s recommended to also check with the central bank as they govern all the banks within the country.

When you need statements from a closed bank account, there are two main ways to request them:

The first step is to contact your former bank directly via phone call or email. When you contact them, be sure to:

Understand that it may take weeks or even months to receive the statements once requested. The bank may need time to retrieve archived records.

With that here is an email template that you can send to your bank to request an old bank statement:

Subject: Request for Statements from Closed Account

Dear [Bank Name],

I am writing to request archived statements from an old, now-closed account that I held with your bank.

The details are:

Full Name: [Your First and Last Name]

Account Number: [Your old account number]

Account Type: [Checking, Savings, etc.]

Branch Location: [City, State of branch where account was opened]

I am requesting statements from [Month/Year] to [Month/Year]. I require these statements for tax audit purposes [or state other purpose].

Please let me know if you have these statements on file and are able to provide them to me. I understand there may be fees associated with retrieving archived documents. Could you please provide me with an estimate of these fees if possible?

Please send the statements to:

[Your mailing address]

I’ve also included a copy of my driver’s license to verify my identity.

Thank you for your assistance with this matter. Please let me know if you need any additional information from me. I look forward to your reply.

Sincerely,

[Your name]

You can also visit your old bank branch in person and make the request for your closed account statements.

This may allow you to get the statements faster, but likely involves completing paperwork to verify your identity and formalize the records request. Things to keep in mind:

With both options, patience and following bank procedures are key to getting those old bank statements from closed accounts!

When a bank account is closed, either by the customer or the bank, the bank still retains records of the account for a period of time. Knowing typical bank policies for closed accounts can help manage expectations when trying to obtain old statements.

In summary, while accessing very old closed account records can be difficult and costly, banks often keep them in archives longer than required. Understanding general bank policies sets appropriate expectations.

Related information and sources: Source, Source, Source.

Trying to get old bank statements from accounts you closed long ago can present some challenges and it can be a long process.

So for sure prepare your nerves as with almost anything that is out of the way for a bank, it will be a long and difficult process in most cases.

Here are some common issues and tips to address them:

With patience and systematically working through these potential issues, you can usually get the closed account bank statements you need. Escalate to bank management or regulatory agencies if all else fails.

In case you’re feeling treated unfairly by the bank you can contact your central bank or Consumer Financial Protection Bureau (CFPB).

After going through the process of retrieving old bank statements for closed accounts, you may need to convert the PDF bank statements into Excel/CSV format. This allows the data to be easily analyzed, manipulated, and integrated.

Converting years or decades-old PDF bank statements presents challenges. The statements may have low-quality scans or non-standard layouts that generic converters cannot accurately process. But for purposes like tax prep or audits, you need maximum accuracy.

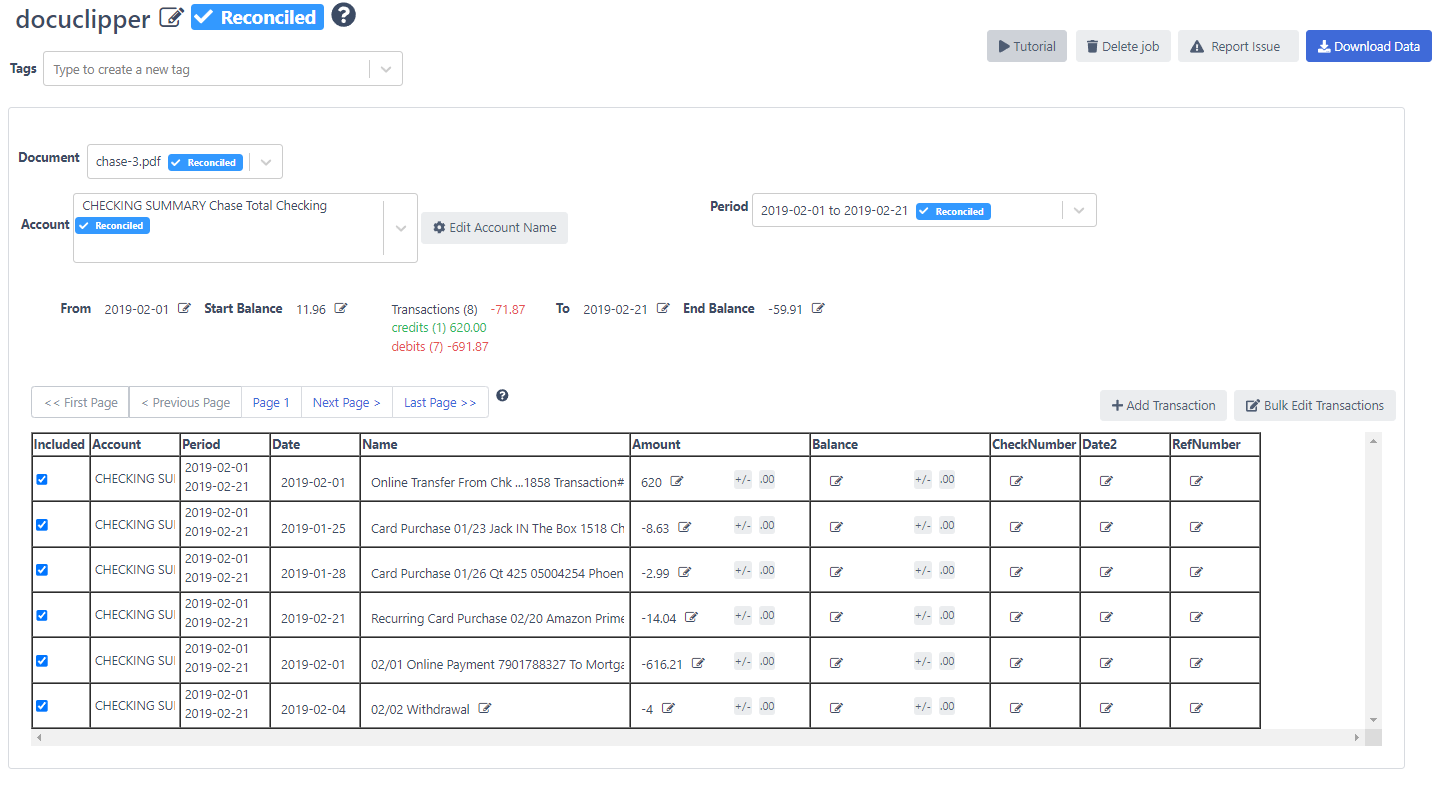

This is where advanced bank statement converters like DocuClipper prove invaluable. DocuClipper is trained on over 1,000,000 real bank statements to handle even complex documents with 99.5% OCR accuracy. It can intelligently extract all transaction details, text, and tables from old PDF bank statements into a clean Excel/CSV output.

With customizable output options, DocuClipper ensures you get bank statement data just the way you need it for tasks like:

When you need to digitalize old bank statements from closed accounts, a bank statement converter like DocuClipper provides the best way to get accurate Excel/CSV output. This eliminates manual data entry and saves hours of time.

Learn more about:

Getting old bank statements from accounts you closed long ago can seem daunting, but is feasible with the right approach.

The keys are understanding bank policies for retaining closed account records, requesting the statements systematically, and persistently following up and escalating your request if needed.

While there may be challenges along the way, such as fees or identity verification, the statements can usually be retrieved with patience and by utilizing bank management or regulatory resources if appropriate.

Once obtained, specialized AI-Infused OCR tools like DocuClipper make it easy to digitize even decades-old bank PDF statements into usable Excel/CSV formats.

So don’t assume closed account records are gone forever – more often than not, with concerted effort, you can access the bank statements you need.